In the cryptocurrency sector, VASP compliance is now a basic requirement for legal operations. Global regulatory requirements continue to increase.

VASP compliance frameworks set standards for accountability, transparency, and security. They help businesses meet obligations and provide basic protections for users.

Why VASP Compliance Matters

This is about staying alive in the business. Proper compliance delivers these outcomes:

- Financial institutions stop refusing service outright.

- Criminals have a much harder time moving money through your service.

- Customers feel safer handing over their data and funds.

- You can realistically expand to new markets instead of hitting walls.

- The risk of seven- or eight-figure penalties drops sharply.

Key Components of Effective VASP Compliance

There are key pillars to VASP compliance.

The starting point is obtaining the required license. This must be supported by strong AML/CFT and KYC frameworks. Operations need constant transaction surveillance. A formal risk management process is required to handle threats.

Compliance also demands scheduled reporting to regulators. And everything depends on advanced security measures to safeguard the business.

Missing any element creates a significant risk.

VASP Compliance Services for Legally Operated Crypto Platforms

Managing VASP compliance requires specific legal and regulatory expertise. Specialized service providers exist to guide companies through this process. The firms listed below are established leaders in providing crypto compliance solutions.

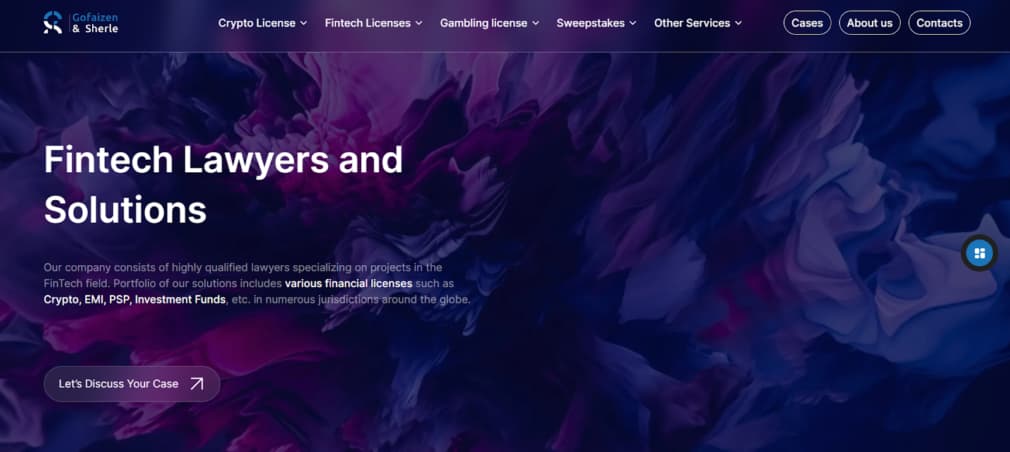

1. Gofaizen & Sherle

Gofaizen & Sherle is an international consulting and legal firm specializing in regulated business models for FinTech, digital assets, payments, forex, and iGaming.

The firm acts as a single strategic partner for companies building or scaling in complex regulatory frameworks across 50+ jurisdictions. Its core approach is the application of engineering principles to build sustainable regulatory architecture for long-term growth, rather than merely obtaining individual licenses.

The firm offers comprehensive support for establishing legally compliant crypto operations in a wide range of key markets. This includes facilitating the acquisition of a crypto license in Canada, meeting the regulatory framework for a crypto license in El Salvador, and obtaining a crypto license in Switzerland.

For entities considering offshore structuring, the firm provides guidance on securing a crypto license in the BVI and a crypto license in the Cayman Islands, as well as a crypto license in Panama and a crypto license in Costa Rica.

Additionally, their expertise covers specific regional requirements like the Montana MSB license and supports businesses seeking a crypto license in Australia.

Practical services for running a compliant crypto business.

- Obtaining VASP, crypto, and MiCA CASP licenses globally.

- Designing full-cycle regulatory compliance architecture and governance models.

- Strategic jurisdiction selection and corporate structuring for international groups.

- Adapting business models to FATF standards, MiCAR, and local AML/CTF regimes.

- Providing centralized regulatory risk management and ongoing compliance support.

- Facilitating banking and payment provider onboarding.

Their primary strength is an architectural, business-oriented approach to regulation. This approach shapes how a VASP License from Gofaizen & Sherle is structured, resulting in an operationally sound and regulator-resilient model that supports secure scaling.

With a proven track record of over 800 obtained licenses and expertise across a wide spectrum of financial services, the firm is equipped to manage complex, multi-jurisdictional compliance for entities ranging from startups to large international groups.

2. Fast Offshore Licenses

Fast Offshore Licenses is a consulting firm providing personalized licensing and compliance services for virtual asset businesses, iGaming, and forex.

The company offers end-to-end support from company formation and jurisdiction selection to license registration and ongoing legal advice. Services are designed to help crypto exchanges and VASPs achieve legal approval and maintain operations under evolving international standards.

Key services for VASP compliance and secure crypto operations include:

- VASP and crypto exchange license application preparation and submission.

- Corporate structuring and ready-made company registration.

- Guidance on EU MiCA regulation and CASP license acquisition.

- Compliance alignment with AML, CTF, and KYC requirements.

- Assistance with ancillary financial licenses (Forex, MSB, Gaming).

- Offshore company registration for operational efficiency.

The company’s value lies in its practical, specialized focus on licensing. Fast Offshore Licenses provides straightforward authorization pathways across various jurisdictions, helping businesses manage specific regional requirements from European to offshore markets.

3. Vertex Compliance

Vertex Compliance provides compliance and risk management services. The firm supports businesses in meeting regulatory requirements, with a focus on financial crime compliance for companies without internal compliance teams.

With experience in banking, regulatory affairs, and IT, Vertex offers technology-enhanced consulting to meet both local and international obligations, including specialized crypto and VASP services.

Key services for VASP compliance and secure crypto operations include:

- Regulatory support: AML/FATF policies, audits, ongoing monitoring, and local crypto rules.

- Risk management: assessments, transaction monitoring, cyber threat controls.

- Compliance staff training on procedures and best practices.

- Consulting: FATCA/CRS, data protection, trade finance.

- Anti-fraud systems and operational security setup.

The company’s advantage is its focused approach to risk management and staff enablement using technology. Vertex creates practical, customized compliance strategies specifically for crypto businesses, helping them establish internal compliance capabilities and adapt to regulatory changes.

4. Global Law Experts

Global Law Experts (GLE) functions as an international legal network with vetted professionals across 140+ countries. The network delivers jurisdiction-specific expertise in corporate law and regulatory compliance through a collaborative model where member firms coordinate on multi-jurisdictional matters.

Key services for VASP compliance are:

- Linking businesses with pre-vetted local lawyers for jurisdiction-specific advice.

- Strategic legal support for international regulatory issues and corporate structuring.

- Counsel on related legal areas, including corporate, tax, and IP law.

- Coordinated multi-jurisdictional strategy development.

- Technology tools for managing international legal requirements.

The network’s primary value is its curated global network of local legal experts. This gives VASPs direct access to specialized on-the-ground knowledge in each operational jurisdiction, ensuring compliance approaches are technically correct and culturally attuned to local regulatory requirements.

5. Crypto License

Crypto License provides legal services focused on establishing licensed cryptocurrency operations worldwide. The firm specializes in helping businesses obtain crypto exchange and VASP licenses by managing regulatory requirements in specific jurisdictions. Services cover corporate setup, documentation, and regulatory liaison.

Core offerings for VASP compliance:

- Securing crypto exchange licenses in jurisdictions like the UK, Estonia, Lithuania, Poland, the USA, and the UAE.

- Forming companies with structures designed for licensed crypto operations.

- Handling complete license application preparation and submission.

- Advising on jurisdiction-specific capital, AML/CFT, and insurance mandates.

- Monitoring and advising on regulatory changes affecting exchange licensing.

The firm’s value lies in its focused, practical approach to license acquisition. Crypto License delivers targeted solutions for authorization in major crypto markets, serving businesses that need to launch or grow a licensed exchange operation in specific countries.

Conclusion

Operating a secure and legal crypto business requires VASP compliance. Professional guidance is often critical to manage licensing, AML/KYC, and reporting obligations.

The listed firms—Gofaizen & Sherle, Fast Offshore Licenses, Vertex Compliance, Global Law Experts, and Crypto License—have distinct specialties. Businesses should choose based on their size, target jurisdictions, and specific regulatory challenges.

A solid compliance partner helps mitigate legal risks, facilitates banking access, and enhances credibility. This is now a standard cost of business operations.